Ask yourself why you went into business for yourself. We’ll bet you don’t respond with ‘to spend my days working on financial accounts’!

Managing your accounts yourself is an understandable approach, particularly amongst start-ups and small businesses. After all, it’s these early days where you need to be as frugal as possible to turn a profit and begin to grow your enterprise.

However, it turns out that by taking on this admin yourself, you’re costing your business money rather than saving it.

What if we told you that managing your business accounts is losing you at least £15,000 a year?

We surveyed over 500 business owners in the UK, and 27% stated that they tackle payroll, VAT returns, invoices and their bookkeeping on their own.

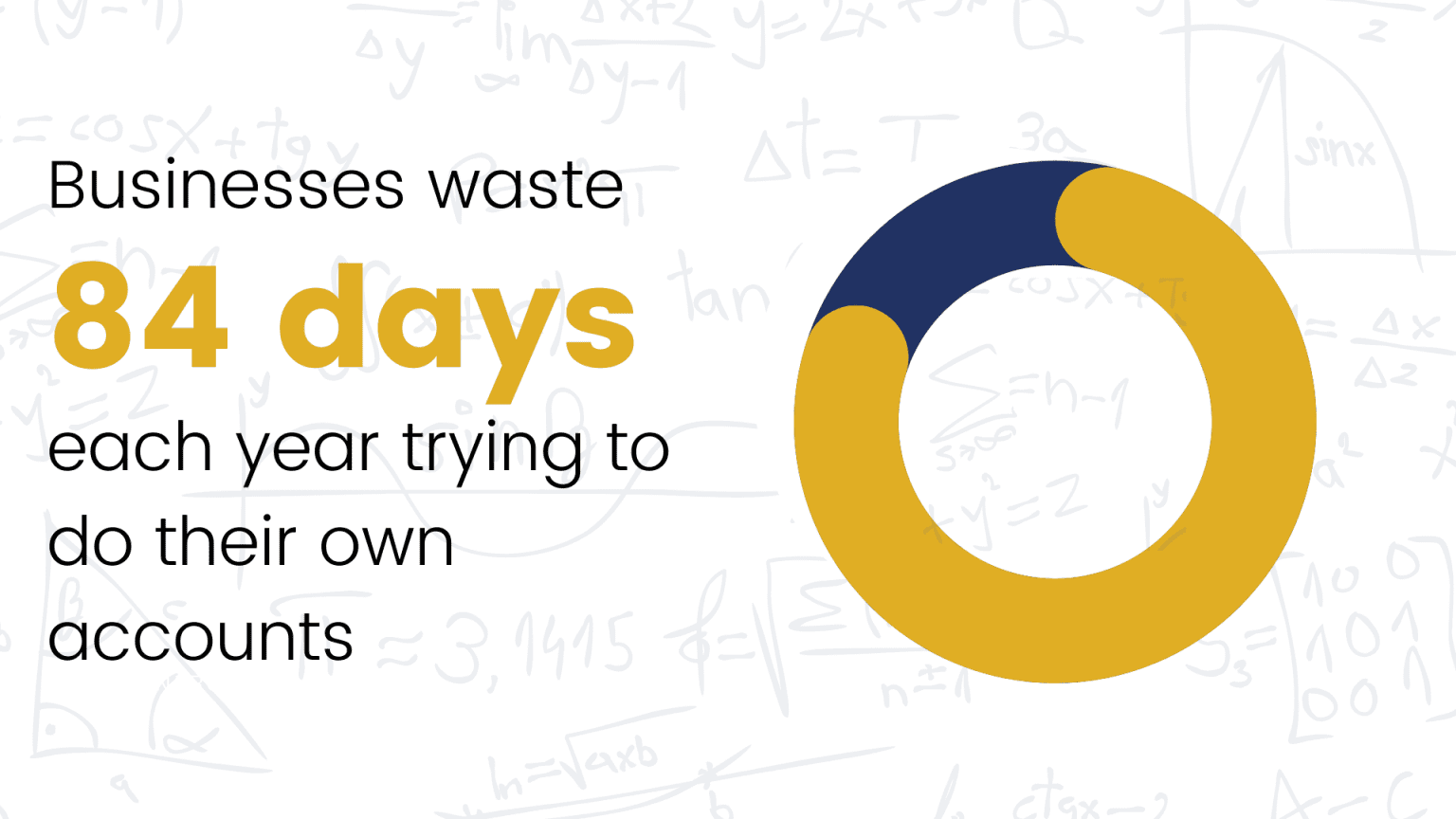

The total time that it takes to complete the above on average is 80 days per year, this is time that you could be working on the day to day of your business or time spent with those all important clients 🤝

Overall, UK small businesses are losing time equivalent to £25 million per year which equates to £15,000 per year per business! We know what we’d rather be spending our money on…

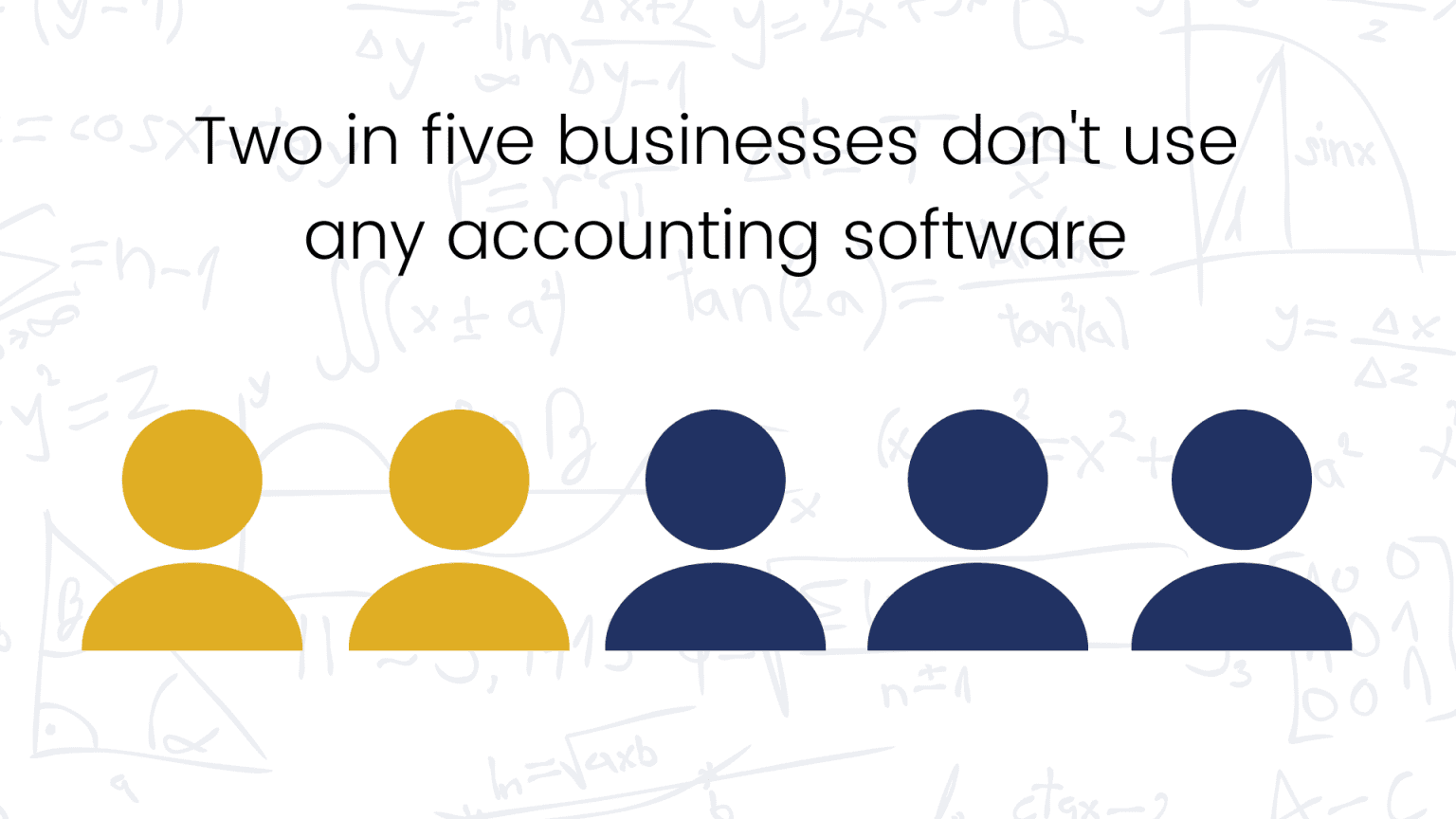

Our survey also found that 54% of businesses don’t have bank feeds tied into their accounting software and nearly 20% don’t use any accounting software at all. This disconnect means they’re spending even more time away from their business than they have to and more importantly, losing even more money.

Only 42% of small-to-medium companies are still operational after five years so finding ways to save as much as possible is essential for the safety and health of your business.

More than that, you may not be aware of the multiple ways you could save money and be efficient with your company finances. That means that by working with an accountant, you could find yourself enjoying considerable cost savings that you can invest back into your business.

What £15,000 annual savings could mean for your business

£15,000 is a considerable loss, one that could be put to much better use. For example, you could use your savings to:

- Take on an apprentice – the minimum age for an apprentice aged 16-18 means their gross salary would be £6,708 each year for a 30 hour-per-week contract.

- Build your own warehouse space – each square foot will cost you between £64 and £84 to build your own space rather than rent it. That means that you can snap up 178 square feet of space on the lowest end of the scale to store your products.

- Hire an entire accounting and financial management team – when you partner with Gravitate Accounting, you can leave the numbers to the professionals while you continue building your brand.

- Launch an entirely new product line – most enterprises raise £5,000 to launch their business. So, you could easily launch three entirely new product lines with your savings.

Outsourcing your accounting administration really is the best option

At Gravitate Accounting, we understand how important your business is to you, which is why we take a partnership approach with all our clients. Rather than work for you, we will work with you to help you achieve your KPIs and financial goals. Every member of our team comes with individual skills and experience and is passionate about what they do. So why not get in touch to understand how we can help you save money and gain time to do what you genuinely love.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.webp)

.webp)

.jpg)

.webp)

.png)

.svg)