Growth shares are an effective way for UK companies to retain top talent, reward key team members, and manage equity without reducing the value held by existing shareholders. They can also offer significant tax advantages for suitable businesses.

One of the most important aspects of a successful Growth Shares scheme is getting the business shares valuation right.

In this blog, we’ll outline everything you need to know.

What is a Growth Shares valuation?

Given growth shares are based on long term value and growth, an accurate valuation is everything. Without this, the whole scheme fails.

A defensible and accurate valuation is the foundation of your tax defensibility, your evidence of compliance, and the basis of tax efficiency.

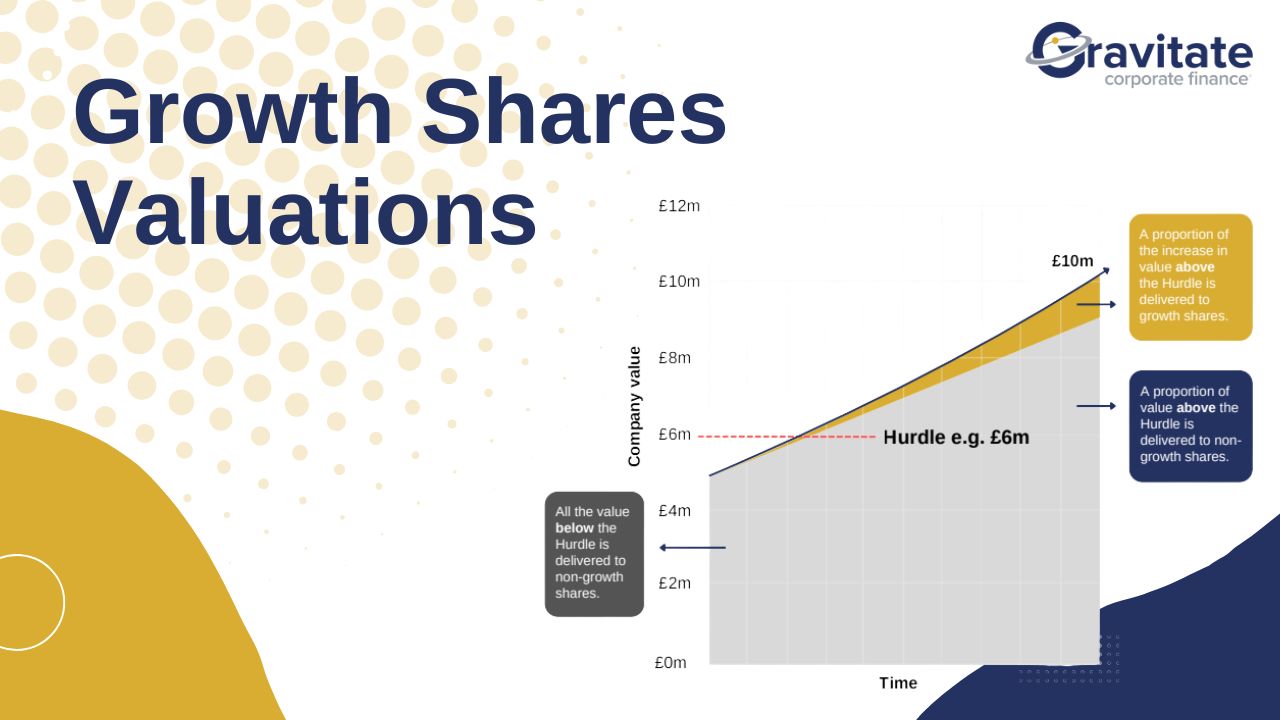

A typical growth share scheme is structured to ensure the shares only gain value if the company valuation exceeds a pre-defined hurdle. This means they carry little to no value at the point of grant.

But you can’t just say this and hope HMRC believe you!

You need a professional, well-reasoned valuation that supports your claim and outlines exactly why those shares were effectively worthless when granted.

Why an accurate valuation is key

If HMRC thinks the shares had value at the time of grant, employees could be charged Income Tax on that value (at rates of up to 45%!) An accurate valuation removes this risk.

A proper valuation, paired with a Section 431 election, means you can treat future growth as a capital gain. Without it, HMRC could reclassify part of the exit value as income.

HMRC regularly challenges equity valuations, especially in high-growth businesses. If your valuation methodology is robust, you’re better prepared to defend your structure during any future review.

So how are growth shares valued?

There are numerous valuation methods available, and the most suitable can vary. However, a growth shares valuation will typically use one of the following approaches.

Discounted Cash Flow Valuation

This projects future earnings and discounts them to present value and is usually best suited to mature or revenue generating companies.

Comparable Company Analysis

This includes looking at similar businesses and comparable market valuations to set benchmarks.

Hope Value Modelling

This focuses on speculative, future-only value of the shares, and is the most common method for early-stage or high-growth firms.

Who should conduct the growth shares valuation?

Whichever method you use, make sure you work with a qualified valuation expert, clearly document all key assumptions (like forecasts and hurdles), apply relevant discounts for restrictions, and keep a full record of the report and supporting evidence to protect against HMRC scrutiny!

We can help

The success of a growth shares scheme is underpinned by the quality and defensibility of the valuation. Without getting this step right, the whole scheme can fall down. That’s why Gravitate specialises in producing valuations for this very purpose.

While a company’s financial performance and balance sheet strength often play major roles in determining its overall valuation, it’s equally important to understand how the business operates, the sectors it serves, and how it engages with its customers. That is the approach we take with every valuation.

Contact us today if you require assistance!

Download our free Growth Shares guide

We’ve created a comprehensive guide to Growth Shares designed for modern business owners, which you can download today to explore this valuable incentive in more detail.

And don’t worry, no sales calls will follow your download (though we’d love to hear your thoughts on the guide!)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.webp)

.webp)

.jpg)

.webp)

.png)

.svg)